do nonprofits pay taxes on investment income

Investment management fees cost them 0542 percentage points. Entities organized under Section 501 c.

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

Up to 25 cash back Sometimes nonprofits make money in ways that arent related to their nonprofit purposes.

. Do Nonprofits Pay Taxes. When your nonprofit incurs debt to acquire an income-producing asset the portion of the income or gain thats debt-financed is generally taxable UBI. We never bill hourly unlike brick-and-mortar CPAs.

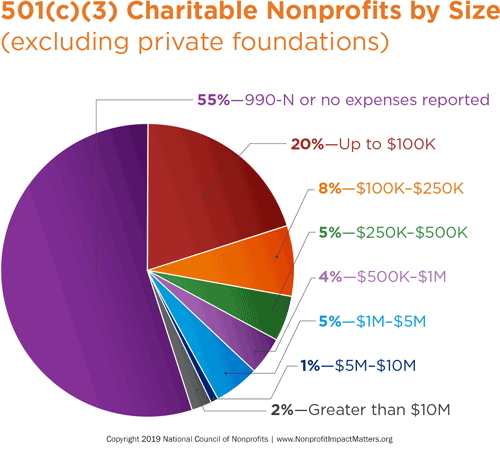

Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. Nonprofits that qualify for 501c3. Long-term capital gains come from assets held for over a year.

In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of. When your nonprofit incurs debt to acquire an income-producing asset the portion of. As long as a 501 c 3 corporation maintains its eligibility as a tax-exempt organization it will not have to pay tax on any profits.

Do nonprofits pay taxes on investment income. However this corporate status does not. For tax years beginning after Dec.

For tax years beginning on or before Dec. Do nonprofits pay tax on investment income. Do 501c3 pay taxes on donations.

While nonprofits can usually earn unrelated business income UBI. Enjoy flat rates with no-surprises. Do nonprofits pay tax on investment income.

Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of federal. But nonprofits still have to pay. Yes nonprofits must pay federal and state payroll taxes.

Do nonprofits pay taxes on salaries. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. How much is capital gains in 2021.

Short-term capital gains come from assets held for under a year. Do nonprofits pay taxes on dividends. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. First and foremost they arent required to pay federal income taxes.

Below well detail two scenarios in which nonprofits pay tax on investment income. Consulting fees account for 0119 percentage points and custodial fees 0053 percentage points. Taxable if Income from any item given in exchange for a donation that costs the.

Most nonprofits fall into the 501c3. Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types.

Your recognition as a 501 c 3 organization exempts you from federal income tax.

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Charities And Nonprofits Intentional Accounting

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

Myths About Nonprofits National Council Of Nonprofits

Bookkeeping For Nonprofits Track Funding With Mip

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Nonprofit Accounting Explanation Accountingcoach

Are 501 C 3 Stock Investment Profits Tax Exempt

Sources Of Personal Income In The United States Tax Foundation

An Overview Of Capital Gains Taxes Tax Foundation

Private Foundations And The Excise Tax On Net Investment Income

Beginner S Guide To Nonprofit Accounting Netsuite

How To Start A Nonprofit In 7 Steps 2022

Should Nonprofits Seek Profits

Non Profit Vs Not For Profit Top 6 Best Differences With Infographics

Investment Tax Fisher Investments

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Irs Form 990 Filing Instructions And Requirements For Nonprofits

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities